12 Best AI Tools for Ecommerce Success in 2025

Why 2025 is the year to pick your AI stack

If you’re serious about growth this year, the question isn’t whether to adopt ai tools for ecommerce—it’s which ones fit your stack. From discovery and search to pricing, support, fraud, and analytics, ai ecommerce tools now cover the whole funnel with faster time-to-value than ever. Shopify itself is pushing hard on native AI—Magic and Sidekick for content, insights, and tasks—along with AI search moves (Vantage Discovery) that signal where the platform is headed. Shopify+2Shopify Help Center+2

How we chose (short & sharp)

Use-case fit: Clear impact on sales, conversions, or support.

Time-to-value: Quick setup, default wins out of the box.

Ecommerce native: First-class integrations with Shopify and common D2C tooling.

Proof: Credible customer stories or analyst recognition.

Pricing clarity: Transparent tiers or well-documented pricing models.

Data & governance: Role-based access, auditability, and security basics.

Tool | Category | Best for… | Starts at* | Notable integrations | Platforms |

Verifast AI | Conversational sales & support | D2C chat that sells + automates support | Request demo | Shopify, CRMs, logistics | Web, WhatsApp |

Shopify Magic & Sidekick | Storefront AI + assistant | Drafts, insights, and task automation inside Shopify | Included/varies | Native Shopify | Shopify |

Algolia AI Search | AI search & discovery | Hybrid semantic+keyword search at scale | Free tier / usage | Shopify, APIs | Web, mobile |

Bloomreach Discovery | Search + merch + recs | Enterprise-grade product discovery | Request demo | Shopify & enterprise stack | Web, mobile |

Nosto | Personalization/CXP | On-site recs, content, search | Request demo | Shopify, major ESPs | Web |

Klaviyo AI | Email/SMS AI | Predictive segments, gen-AI content | Free/paid tiers | Shopify, Meta, etc. | Web |

Signifyd | Fraud & abuse | Automated approvals, chargeback protection | Request demo | Shopify, major PSPs | Web |

Intelligence Node | Dynamic pricing | Price/assortment optimization | Request demo | Feeds/APIs | Web |

Triple Whale (Moby AI/Agents) | AI analytics & agents | Forecasting + BI automations | Paid | Shopify, ads platforms | Web |

Syte | Visual search & tagging | Fashion/home visual discovery | Request demo | Shopify, custom APIs | Web, mobile |

Yotpo (AI Reviews/UGC) | Reviews & UGC AI | Review capture, AI summaries, loyalty | Free/paid | Shopify, SMS, ESPs | Web |

Instantly | Leads and Email Campagins | Leads & create campaigns | Paid | Web, Email |

The 12 Best Ecommerce AI Tools (deep dives)

Verifast AI — AI Sales & Support Agent for Ecommerce (Deep Dive)

Best for: D2C brands that want a single conversational layer to sell more (pre-purchase guidance, bundles, discount nudges) and support better (order tracking, exchanges, returns) without juggling multiple tools.

Why it stands out in 2025 (beyond “another chatbot”)

Verifast AI stands out with its sales-driven strategy, conversion-oriented features, and revenue-priced model that are a perfect fit for growth-driven businesses. Through detailed customer performance analytics, brands can track revenue attribution by UTM source, measure stage-by-stage funnel drop-offs, and monitor chatbot-assisted conversion rates to continuously optimize ROI and justify AI investment based on quantifiable business impact.

Captures qualified leads within natural conversation flow. Tags leads with purchase intent, preferences, and concerns. Through advanced user profiling and segmentation, the system automatically categorizes visitors by behavior, journey stage, and Shopify events—enabling personalized chatbot flows for new versus returning customers and powering targeted retargeting campaigns based on granular engagement data.

Showing a personalized carousel, applying a coupon, collecting a lead, or completing a post-sale task. The difference shows up in outcomes: brands using Verifast consistently report 15–30% conversion lifts, up to 17% cart-abandonment reduction, and 85–90% CSAT—with standout case stories across fragrance, Ayurveda, and personal care.

How it drives revenue across the funnel

Discovery → Consideration

Interprets messy, real-world queries (“I love Oud but want something softer” / “dry-skin serum, non-sticky”).

Shows a custom product carousel with one-tap Add to Cart and in-chat comparisons.

Surfaces social proof snippets (ratings, top reviews) right when trust wobbles.

Intent → Conversion

Spots hesitation (dwell time, repeat PDP visits) and triggers contextual nudges: time-bound offers, free shipping, or bundle upsells.

Applies auto-discounts at checkout, eliminating friction and coupon hunt drop-offs.

Post-purchase → Retention

Automates WISMO (“Where is my order?”), address changes, cancellations, returns/exchanges, and delivery updates.

Captures structured CSAT and post-purchase feedback that loops into product/UX decisions.

Insights → Actions

Turns every chat into intelligence: concern clustering (e.g., “sensitivity,” “scent longevity”), SKU interest maps, time heatmaps, and word clouds that double as SEO fuel.

Flags restock opportunities when out-of-stock items keep getting requested.

What real brands achieved (from your docs)

Adil Kadri (fragrance): Closed ₹1.1 crore in a single month, handled 119k+ sessions, and generated 7,182 leads—by bridging language and product-education gaps that traditional support couldn’t.

Dr. Vaidya’s (Ayurveda): ₹15 lakh+ in incremental sales, 50,000+ queries resolved, 4,000+ leads, 25,000+ unique customers handled—powered by intent detection, follow-up questions, dosage guidance, and auto-applied coupons.

Grandmaa Secret (haircare): 25% sales uplift, 15% cart-abandonment reduction, and 30% conversion rate increase, with behavior-based nudges, urgency timers, review-driven reassurance, and personalized recs.

What makes it operator-friendly

Multilingual at scale: Handles 100+ languages & dialects (incl. colloquialisms/typos) to unlock “Bharat” (Tier-2/3) and global traffic.

Brand voice control: Luxury-calm or Gen-Z cheeky—responses mirror your tone.

UI customization: Widget/button design that matches your storefront (no generic look).

Channel coverage: Web widget + WhatsApp (for high-reach re-engagement).

Integrations that matter: Shopify (catalog, orders, customer profiles), logistics like Shiprocket/ClickPost for real-time tracking, and CRMs (HubSpot/Zoho) for lead sync.

No-code onboarding: Plug-and-play to go live quickly; monthly feature rollouts.

30/60/90 Playbook (how to pilot and scale)

Day 0–30 (Quick wins):

Connect Shopify + shipping + CRM.

Import catalog & FAQs; enable PDP carousels and checkout nudges.

Turn on abandoned-cart rescue in chat + WhatsApp reminders.

Capture lead hooks (phone/email) with value-exchange prompts.

Ship post-purchase automation (WISMO, exchanges/returns).

Define one KPI to prove value (e.g., conversion on chat-touched sessions).

Day 31–60 (Tuning):

Personalize by new vs returning visitors (offers, tone, speed to offer).

Layer bundles/upsells for the top 10 SKUs by chat interest.

Use concern clusters to update PDP FAQs and ad messaging.

Day 61–90 (Scale):

Expand multilingual coverage and late-night hours.

Feed word clouds into SEO & landing-page copy.

Roll out campaign-specific scripts (festive sales, new launches).

Add A/B tests for nudge type (free shipping vs % off) and timing.

Pricing & fit

Verifast commonly aligns pricing to outcomes/usage, which makes sense for growth teams who want cost mapped to revenue or support volume. It performs best when the brand connects catalog + orders + logistics so the agent can both sell and solve end-to-end.

Pros

Rare combination of sales + support depth in one conversational layer.

Insight loop (concerns, word clouds, SKU interest) that informs SEO, merch, and product. By leveraging content and SEO intelligence extracted from real customer conversations, brands can identify high-intent search phrases, optimize product page content based on recurring queries, and create ad campaigns that resonate using the exact language customers use when expressing their needs and concerns.

Fast time-to-value with no-code start and operator-friendly dashboards.

Cons

To unlock full value, wire up the stack (Shopify, shipping, CRM)—otherwise you’ll get strong pre-purchase help but less post-purchase automation.

As you scale, you’ll want an ops cadence (weekly reviews of concerns/SKU trends) to keep improvements compounding.

Who it’s for

D2C teams who want a single tool to lift conversions, cut abandonment, deflect tickets, and generate insights—without spinning up separate vendors for chat, support desk, and analytics. Among the best ai tools for ecommerce 2025, Verifast is the pick when “assisted purchase” and post-sale automation are top-line priorities.

Shopify Magic & Sidekick — Native Storefront AI

Best for: Store owners who want AI where they work—inside Shopify.

Why it’s good in 2025: Shopify has made AI a baseline skill for operators and keeps expanding native capabilities (content generation, insights, task execution, and an AI assistant that understands your store context). The Vantage Discovery acquisition shows Shopify’s intent to deepen AI search for merchants.

Key features

Sidekick: AI assistant trained on Shopify that can draft, analyze, and execute tasks with store context.

Shopify Magic: AI copy, images, and replies across storefront content and workflows. Shopify

AI search direction: Strengthened via Vantage Discovery acquisition (gen-AI search focus). Business Insider

Notable integrations: Native—works across Shopify admin and apps.

Pricing snapshot: Included/varies by plan and feature availability. Reuters

Pros: Zero lift if you’re on Shopify; strong roadmap momentum.

Cons: Most powerful inside Shopify ecosystem; advanced discovery may still need a specialist tool for some catalogs.

Who it’s for: Shopify-first brands needing ecommerce ai tools embedded in daily ops.

Algolia AI Search — Hybrid Semantic + Keyword Search

Best for: Fast, scalable search and discovery with API control.

Why it’s good in 2025: Algolia blends vector/semantic understanding with classic keyword relevance to deliver precise results at speed—and supports multilingual personalization and dynamic re-ranking. algolia.com

Key features

AI relevance tuning, real-time personalization, dynamic re-ranking.

Notable integrations: Shopify app ecosystem + APIs for custom stacks.

Pricing snapshot: Free tier and usage-based plans.

Pros: Developer-friendly; high performance; global language support.

Cons: Needs product/engineering involvement to shine.

Who it’s for: Teams that want search they can fine-tune, not just plug in.

Bloomreach Discovery — AI Product Discovery (Search + Merch + Recs)

Best for: Enterprise catalogs needing unified search, merchandising, and recommendations.

Why it’s good in 2025: Combines AI search with rule-based merchandising, SEO tie-ins, and personalization. Strong enterprise adoption and references across retail verticals. Bloomreach+1

Key features

Notable integrations: Enterprise commerce clouds + Shopify connectors.

Pricing snapshot: Sales-led; enterprise contracts.

Pros: Depth across search, merch, and recs; proven at scale.

Cons: Overkill for very small catalogs; requires merch/ops ownership.

Who it’s for: Mid-market/enterprise retailers with big assortments.

Nosto — Personalization / CXP (Predictive, Semantic, Visual & GenAI)

Best for: On-site personalization, recommendations, content, AI search in one CXP.

Why it’s good in 2025: Nosto’s CXP leans on four AI competencies—Predictive, Semantic, Visual, and Generative AI—to personalize experiences across recs, content, search, and merchandising, so you don’t stitch five different tools. Nosto

Key features

Unified CXP: personalization, merchandising, search, and UGC in one stack.

AI engine spanning predictive/semantic/visual/gen-AI for smarter targeting.

Notable integrations: Shopify and major ecommerce/ESP stacks (via apps & APIs).

Pricing snapshot: Sales-led; packaged by modules/usage.

Pros: Broad CXP coverage; strong AI breadth; retail-ready templates.

Cons: Best value when multiple modules are adopted; needs merch/CRM inputs.

Who it’s for: Mid-market brands wanting one pane for ecommerce ai tools (recs + search + content).

Klaviyo AI — Email & SMS with Predictive + Gen-AI

Best for: Owned-channel growth with AI-powered segmentation, benchmarks, and content.

Why it’s good in 2025: Klaviyo bakes predictive analytics (churn, CLV, next order date), benchmarketing, and gen-AI content into email/SMS—tight with Shopify data—so you can ship high-ROI automations fast. Klaviyo

Key features

Predictive metrics + segments; AI content generation; reporting.

350+ integrations; customer profiles unify store + marketing data.

Notable integrations: Shopify, Meta/TikTok ads, dozens of ecommerce apps.

Pricing snapshot: Transparent Email and Email+SMS tiers; public calculators and entry prices.

Pros: Deep Shopify sync; fast time-to-value; strong predictive features.

Cons: Costs scale with list size; advanced setups benefit from ops resources.

Who it’s for: Teams standardizing their lifecycle stack on a single ai solutions for ecommerce platform.

Signifyd — Fraud, Abuse & Returns Protection

Best for: Approving more good orders while guaranteeing chargeback protection.

Why it’s good in 2025: Fraud and abuse (including returns) keep rising; Signifyd provides real-time decisions, custom policy controls, and complete chargeback protection so growth doesn’t spike risk. Signifyd+1

Key features

Automated order decisioning + Decision Center policy engine.

Coverage for fraud & non-fraud chargebacks; returns/abuse intelligence.

Notable integrations: Shopify + major PSPs and commerce stacks.

Pricing snapshot: Sales-led; often a performance/coverage model.

Pros: Liability shift; conversions preserved; strong enterprise credibility.

Cons: Works best with sufficient order volume & data signals.

Who it’s for: Stores where best ai for ecommerce must include risk + revenue protection at scale.

Intelligence Node — Dynamic Pricing & Digital Shelf Analytics

Best for: Competing on price/assortment with near-real-time market data.

Why it’s good in 2025: Intelligence Node tracks competitors, content, and price movements in near real time using ML/computer vision, helping you optimize price, promo, and listings—and monitor your digital shelf.

Key features

Notable integrations: Data feeds/APIs for commerce & BI.

Pricing snapshot: Quote-based subscriptions.

Pros: Fast refresh; breadth of categories; actionable dashboards.

Cons: Requires price/merch ownership to action insights.

Who it’s for: Operators making pricing a core lever among ecommerce ai tools.

Triple Whale (Moby AI / Agents) — AI Analytics & Agentic BI

Best for: Unifying marketing + store data with AI forecasting and agent-style insights.

Why it’s good in 2025: Triple Whale’s Moby AI powers insights and Moby Agents tap a managed warehouse + universal schema—trained on data from $55B+ revenue / 30,000+ brands—to deliver context-aware recommendations. Triple Whale+1

Key features

Forecasting, anomaly detection, creative analytics, channel attribution.

Agentic workflows to answer “why” behind performance and suggest actions.

Notable integrations: Shopify plus major ad platforms and data tools.

Pricing snapshot: Paid plans; add-ons for agents/modules.

Pros: Ecommerce-native BI; strong operator UX; rapid insights.

Cons: Best impact when ad + store data are fully connected.

Who it’s for: Growth teams wanting ai ecommerce tools that answer “what next?”

Syte — Visual Search & AI Tagging (Fashion/Home)

Best for: “See it, shop it” experiences and automated product tagging.

Why it’s good in 2025: Syte’s visual AI fuels image/text search, product deep tagging, and “shop the look,” turning inspiration into conversion—especially for fashion and home. syte.ai+1

Key features

Notable integrations: Shopify + custom APIs.

Pricing snapshot: Sales-led; depends on catalog/traffic.

Pros: Purpose-built for visual categories; improves search & PDP data.

Cons: Delivers most value on image-rich catalogs; tagging rollout required.

Who it’s for: Brands prioritizing visual discovery within e-commerce ai tools.

Yotpo (AI Reviews/UGC, Loyalty & SMS) — Social Proof at Scale

Best for: Capturing more reviews/UGC and turning them into insights + conversions.

Why it’s good in 2025: Yotpo adds AI summaries and sentiment layers over reviews (e.g., Reviews Atlas) to surface recurring themes and accelerate trust on PDPs and in ads. Yotpo+1

Key features

Review capture flows; UGC; AI-driven sentiment/themes; best-practice playbooks.

Works alongside Loyalty & SMS for lifecycle loops.

Notable integrations: Shopify, major ESP/SMS/ads platforms. (See ecosystem on Yotpo.)

Pricing snapshot: Free/paid tiers by features/volume.

Pros: Proven review engine; AI insights make UGC actionable.

Cons: Multiple modules can add cost; plan carefully for ROI.

Who it’s for: Stores where social proof is a primary conversion lever among ai solutions for ecommerce.

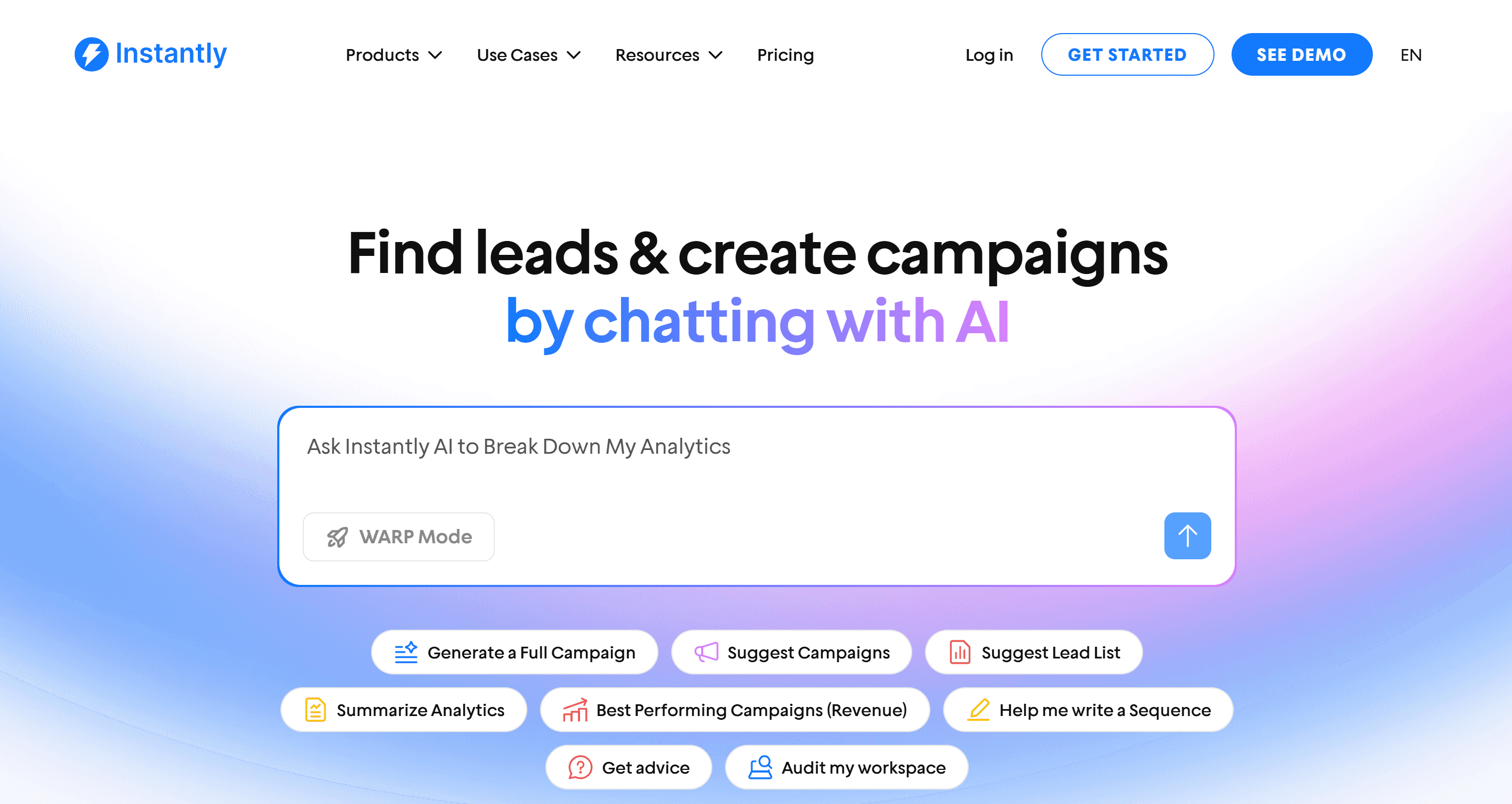

Instantly- ChatGPT for Outreach & Sales

Best for: E-commerce brands and D2C marketers who want to automate cold-outreach, nurture leads, and drive sales by email without hiring extra SDRs.

Why it’s good in 2025: With inbox saturation and rising acquisition costs, Instantly Copilot gives you a modern way to turn outreach into a scalable channel. You can generate full campaigns, personalised sequences, and even schedule recurring tasks—all with AI assistance

Key features

AI-driven campaign generation: give signature message + target profile and let Copilot build the sequence from scratch

Lead list and campaign suggestions: “Suggest Lead List”, “Suggest Campaigns”, etc

Recurring tasks automation: Set daily/weekly/monthly tasks such as new campaigns, analytics summaries, Slack notifications.

Pricing snapshot: Starts at around US $37/month for the “Growth” Outreach tier (1,000 uploaded contacts + 5,000 emails/month) and goes to US $97/month (25,000 contacts + 100,000 emails) for “Hypergrowth”

Pros: Very capable AI assistant that cuts down time from idea to live campaign. Unlimited email accounts + warm-up make it easier for e-commerce outreach scale.

Cons: For true scale or advanced features (e.g., dedicated IPs, extensive CRM + lead database) you’ll need higher tiers or add-ons—so true cost may creep.

Who it’s for: E-commerce founders or marketing leads who want to expand outbound email as a growth channel, especially if they have a list of contacts or can build one and need to automate the process.

FAQ: Picking and Stacking the Right AI Tools for Ecommerce

1) What are the must-have categories of ai tools for ecommerce in 2025?

At minimum: Search/Discovery, Personalization, Owned-channel CRM (Email/SMS), Conversational Sales/Support, Fraud/Risk, and Analytics/Attribution. Add Dynamic Pricing and Visual Search if you have wide assortments or visual-first shopping.

2) How do I avoid tool overlap (paying twice for the same feature)?

Map needs to categories, then assign each outcome to a single owner tool. Example: if Nosto handles on-site recommendations, don’t also turn on recs in your search tool unless you have a defined split (e.g., search owns SRPs; Nosto owns PDP carousels).

3) What’s a sensible “starter” stack for SMBs?

Search/Discovery: Algolia (or Nosto’s Search if you prefer one vendor).

Email/SMS: Klaviyo AI.

Conversational sales/support: Verifast AI.

Reviews/UGC: Yotpo (AI).

That covers conversion, retention, and proof with quick time-to-value.

4) What about mid-market and enterprise?

Mid-market: Nosto (CXP) or Bloomreach for discovery + Klaviyo + Signifyd + Verifast AI + Yotpo + Intelligence Node (pricing).

Enterprise: Bloomreach Discovery as the discovery spine, Signifyd for risk, Intelligence Node for pricing, Triple Whale for AI analytics, plus your preferred CRM and conversational layer.

5) How should I evaluate ai ecommerce tools without a big data team?

Prioritize time-to-value: native Shopify connectors, prebuilt templates, and clear dashboards. Ask for a sandbox and request a 30-day quick-wins plan (what lifts they expect in conversions, AOV, or ticket deflection).

6) What’s typical pricing?

Search/Personalization: usage or GMV-tiered.

Email/SMS: list size + sends.

Conversational AI: seat/usage or conversion-linked.

Fraud/Risk: percentage of protected GMV or performance-based.

Analytics/BI: flat tiers + add-ons.

Always model expected ROI: conversions ↑, cart abandonment ↓, support tickets deflected, chargebacks reduced.

7) Any data/privacy gotchas with ecommerce ai tools?

Check: data residency, encryption in transit/at rest, retention windows, exportability, and RBAC. For EU/UK, ask about GDPR/DPA and subprocessors. For larger stacks, ensure audit logs and SSO/SAML.

8) Build vs buy for ai solutions for ecommerce?

Buy for speed, integrations, maintenance, and model updates. Build only if you have a data platform, MLOps, and a unique need (e.g., custom ranking that generic tools can’t match).

9) How do I pilot without breaking the site or UX?

Run A/B or geo splits: turn a tool on for a subset (10–30% traffic) and measure against control. Define one KPI per tool (e.g., search CTR → add-to-cart → revenue per session).

10) Which KPIs prove these tools are working?

Search/Discovery: search CTR, zero-result rate, revenue per search.

Personalization: AOV, recs-assisted revenue, PDP engagement.

Conversational AI: conversion lift on sessions with chat, CSAT, first-response time.

Email/SMS: revenue per recipient, repeat rate.

Fraud: approval rate, chargeback rate.

Analytics: forecast accuracy, creative ROAS lift.

11) Can I get quick wins in 30 days?

Yes. Examples: enable semantic search, add a recs carousel to PDPs, switch on abandoned cart flows in Klaviyo, deploy a checkout nudge in chat, turn on AI review summaries on PDPs, and use risk decisioning to safely approve more good orders.

Conclusion: Your 2025 AI Stack—Pick, Prove, Then Scale

Ecommerce is past the experimentation phase. In 2025, the winners aren’t the ones with the most tools—they’re the ones with the right ai tools for ecommerce stacked for outcomes: faster product discovery, higher conversion, fewer fraud losses, and scalable support.

A practical pattern looks like this:

Discovery spine: Algolia or Bloomreach (Nosto if you want CXP breadth).

Lifecycle engine: Klaviyo AI for email/SMS.

Conversational layer: an AI agent that sells and supports—this is where Verifast AI shines for D2C.

Trust & margins: Signifyd for protection, Intelligence Node for pricing.

Proof & decisions: Triple Whale to unify signals and suggest next actions.

Social proof: Yotpo’s AI summaries to convert “maybe” into “yes.”

Start small: pilot one or two categories where impact is measurable (search CTR, AOV, recs-assisted revenue, ticket deflection). Once the lift is visible, standardize the wins and expand. Keep each tool accountable to a single KPI, and don’t let overlap creep into the stack.

If you’re scanning for the shortest path to value: prioritize discovery + owned channels + conversational commerce. That trio alone can unlock meaningful lift within a quarter—and set you up to layer the rest when you’re ready.

Written by

Utkarsh Trivedi

.

Co Founder & COO

Published

Sep 17, 2025